PayPay Corporation(hereinafter PayPay)is pleased to announce that cashless payment service “PayPay” will become available as a payment method for donations and fundraising. From August 2024, a total of six charity organizations and companies, including the Red Feather Community Chest, are scheduled to sequentially introduce “PayPay” as a payment method for online donations. This will allow PayPay users to make online donations(※)via “PayPay” whenever and wherever they desire to do so.

※ Only PayPay Money is accepted. Donations will not be eligible for the granting of PayPay Points, and will not be counted in the PayPay STEP program.

Until now, PayPay has entered into merchant agreements with organizations and corporations, allowing them to use “PayPay” as a payment method for their services. Going forward, it will also be possible for charity organizations and companies that operate donation services to offer “PayPay” as a payment method for donations by creating a PayPay account as a business, which is offered to corporations. Initially, six organizations, including the Red Feather Community Chest, will utilize the service, allowing PayPay users to make donations, including those for emergencies such as natural disasters. In addition, by collecting donations in a cashless manner, donating organizations can eliminate the need to collect and tally donations from donation boxes at various locations, while reducing the risks associated with handling cash and getting donations to those in need more quickly.

To ensure that users can use “PayPay” with peace of mind, companies and organizations are required to undergo a rigorous screening process that includes a face-to-face corporate survey and confirmation of the status of their overseas support. Post-integration anti-fraud measures will be enhanced as well such as monitoring suspicious transactions and confirming the status of donations that are made. Further information on companies and organizations eligible for online donations via “PayPay” will be provided in the website as it becomes available.

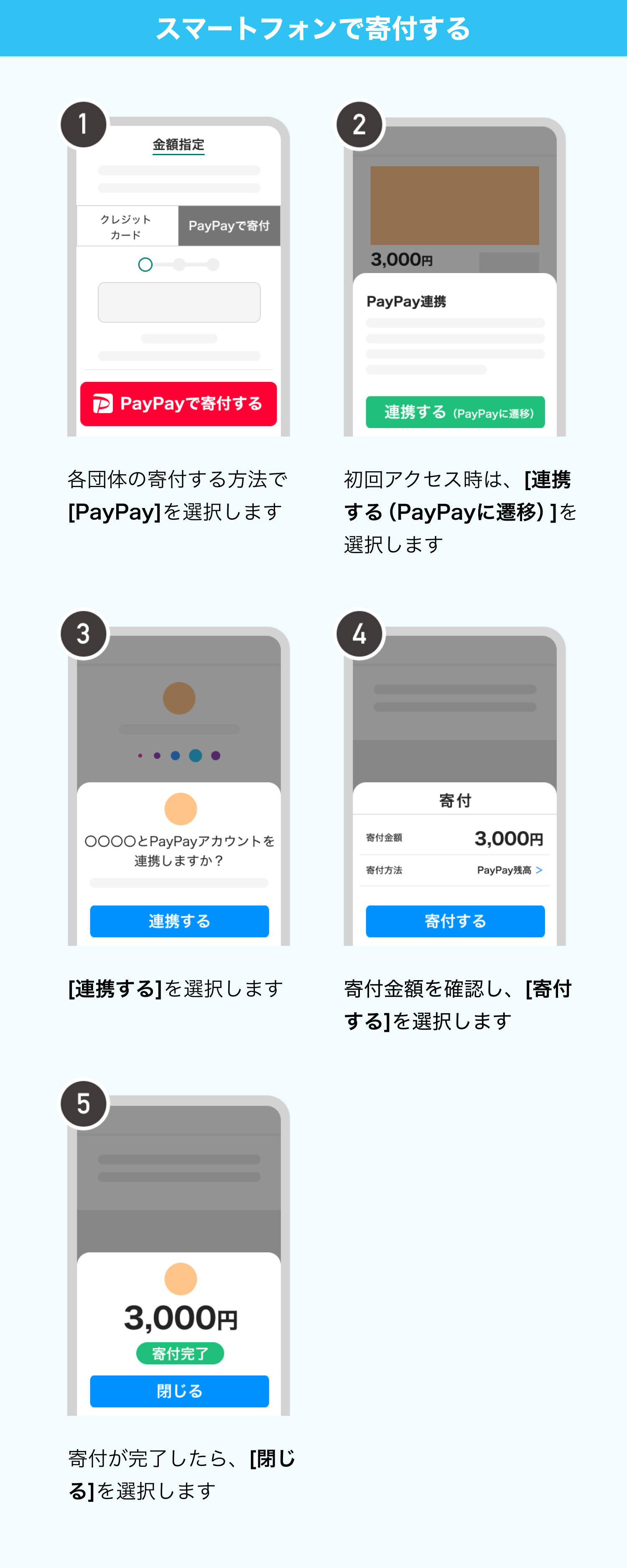

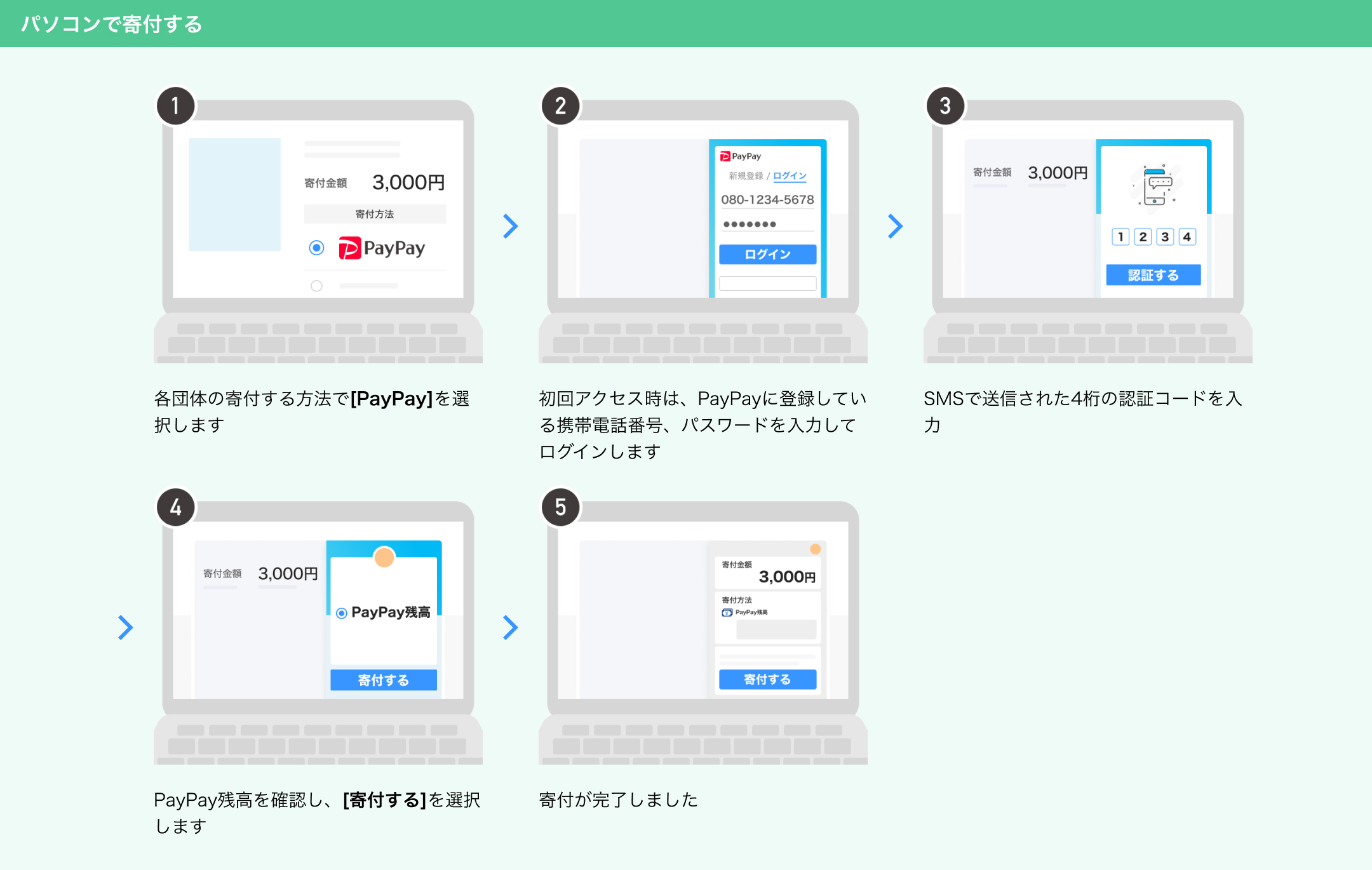

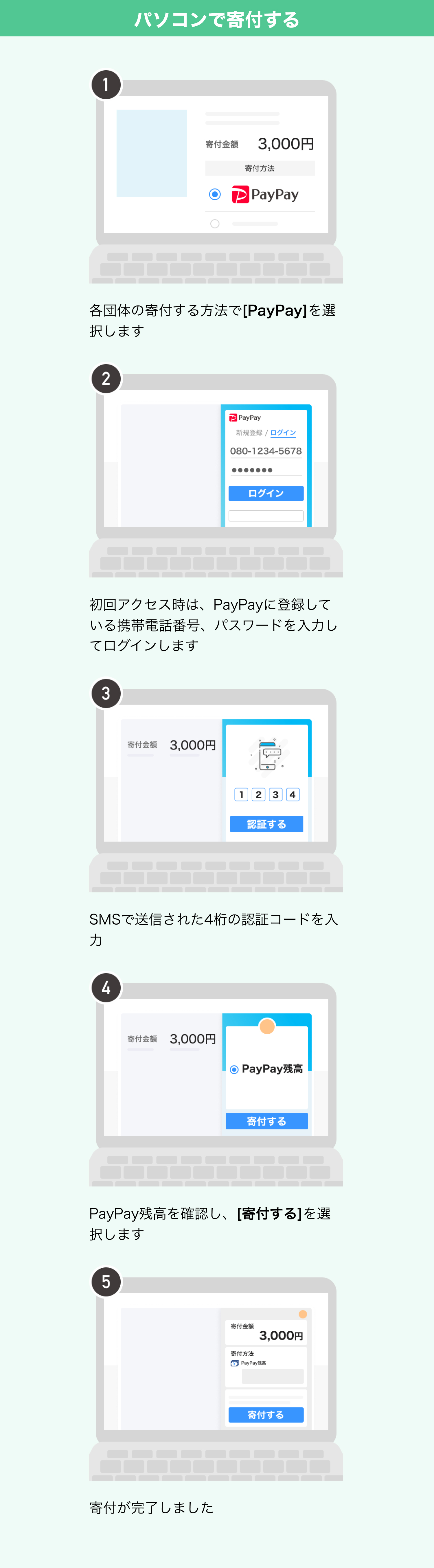

Users are required to confirm their identity (eKYC)to make a donation with “PayPay.” The donation can be completed by entering the desired amount in the website of the donating organization and tapping “Send.” The initial transaction will require authentication through logging in to “PayPay,” but from the second time onwards, the donation can be completed in the respective organization’s website without switching to the PayPay app screen in between. Please note that users will never receive a request from a donating organization to send money. Donations are capped at 300,000 yen per time or within a period of 24 hours, and 500,000 yen within a period of 30 days. For further details on how to use the service, please refer to the service page or websites provided by the respective organizations.

・Online donation guide:https://paypay.ne.jp/guide/donation/

<How to pay for an online donation>

<List of corporations that support donations by “PayPay”> ※In no particular order

| Service | Corporation/organization | When PayPay will be supported |

|---|---|---|

| 24-Hour Television Cashless Donation | 24-Hour Television Charity Committee(Public interest incorporated association) | August 19 |

| Donations to the United Nations WFP | Japan Association for the World Food Programme(Nonprofit organization) | September 6 |

| Peace Winds Fundraising | Peace Winds Japan(nonprofit organization) | September 6 |

| Red Feather Community Chest Central Community | Chest of Japan(Social welfare corporation) | October 1 |

| Yahoo! JAPAN Internet Fund Raising | LY Corporation | Late October |

| Emergency Disaster Relief Fund | Japan Platform(Nonprofit organization) | During 2024 |

※ The indicated dates are subject to change without advance notice.

※ Users will be able to complete payments towards the 24-Hour Television Cashless Donation only through a mini app in “PayPay.”

※ Payments towards Yahoo! JAPAN Internet Fund Raising will initially be available only from smartphones.

PayPay will continue to expand the various scenarios in which business accounts for corporate customers can be used, aiming to evolve into an app that is convenient for both corporations and individual users.

PayPay Corporation is registered as follows:

・Prepaid Payment Instruments(third party type)Issuer(Registration number: Director-General of the Kanto Finance Bureau, No. 00710/Registration date: October 5, 2018)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc.(Registration number: Kanto(K)No. 106/Registration date: July 1, 2019)

・Telecommunications Carrier(Filing number: A-02-17943/Date filed: July 2, 2019)

・Fund Transfer Operator(Registration number: Director-General of the Kanto Finance Bureau, No. 00068/Registration date: September 25, 2019)

・Notified Entity Entrusted with Intermediation(Filing number: C1907980/Date filed: December 18, 2019)

・Bank Agency Services(License: Director-General of the Kanto Finance Bureau(Gindai)No. 396/Registration date: November 26, 2020)

・Financial Instruments Intermediary Services(Registration number: Kanto Finance Bureau Director(Kinchu)No. 942/Registration date: June 25, 2021)

・Electronic Payment Agency Services(License: Director-General of the Kanto Finance Bureau(Dendai)No. 109/Registration date: February 14, 2023)

・Designated Funds Transfer Operator, permitted to provide digital payment of wages(Designation No.: Minister of Health, Labor and Welfare No. 00001/Date of designation: August 9, 2024)

・Japan Payment Service Association(https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Japan Consumer Credit Association(https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

※ “PayPay” offers four types of electronic money and other services: PayPay Money, PayPay Money Lite, PayPay Points, and PayPay Gift Vouchers.

PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out and transferred to a designated bank account(no transfer fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and services, can be remitted or cashed out, and is issued by PayPay who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. PayPay Money(Paycheck)means PayPayMoney that can only be purchased with wages received by the PayPay user in their Salary Account. Based on the provisions of Article 43 of the Payment Services Act, PayPay protects the debt it owes to its users by depositing assets equivalent to or higher than the debt amount related to the funds transfer balance. PayPay Money Lite is a type of electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay(Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Points, which are granted through campaigns and promotions when using PayPay, can be used for partner services and in transactions at merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be transferred between PayPay users or be cashed out. PayPay Gift Voucher is a type of electronic money issued by PayPay, which can be used to make payments for affiliated services and merchants designated by the PayPay Gift Voucher. However, PayPay Bonus and PayPay Bonus Lite cannot be transferred between PayPay users or be cashed out. PayPay Gift Vouchers have an expiration date, after which they will no longer be valid. The deadline for Gift Vouchers can be confirmed in the details or specifications of the measure or promotion campaigns for which they are issued.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, there is a scheme that ensures compensation for the damages suffered(the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see applying for compensation for details.

※ Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.