Influenza Insurance service page:

https://www.paypay-insurance.co.jp/promotion/influenza/app/

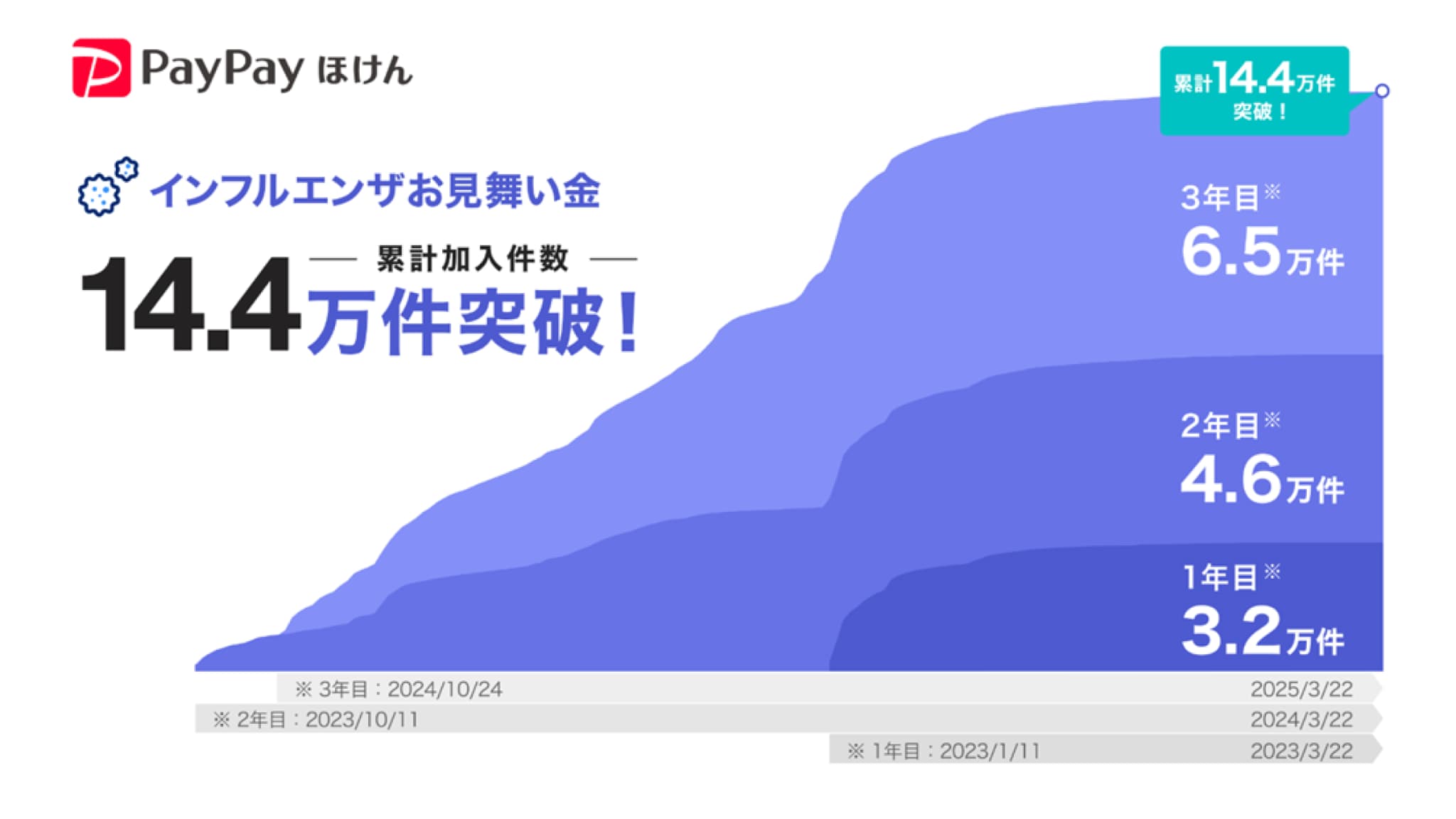

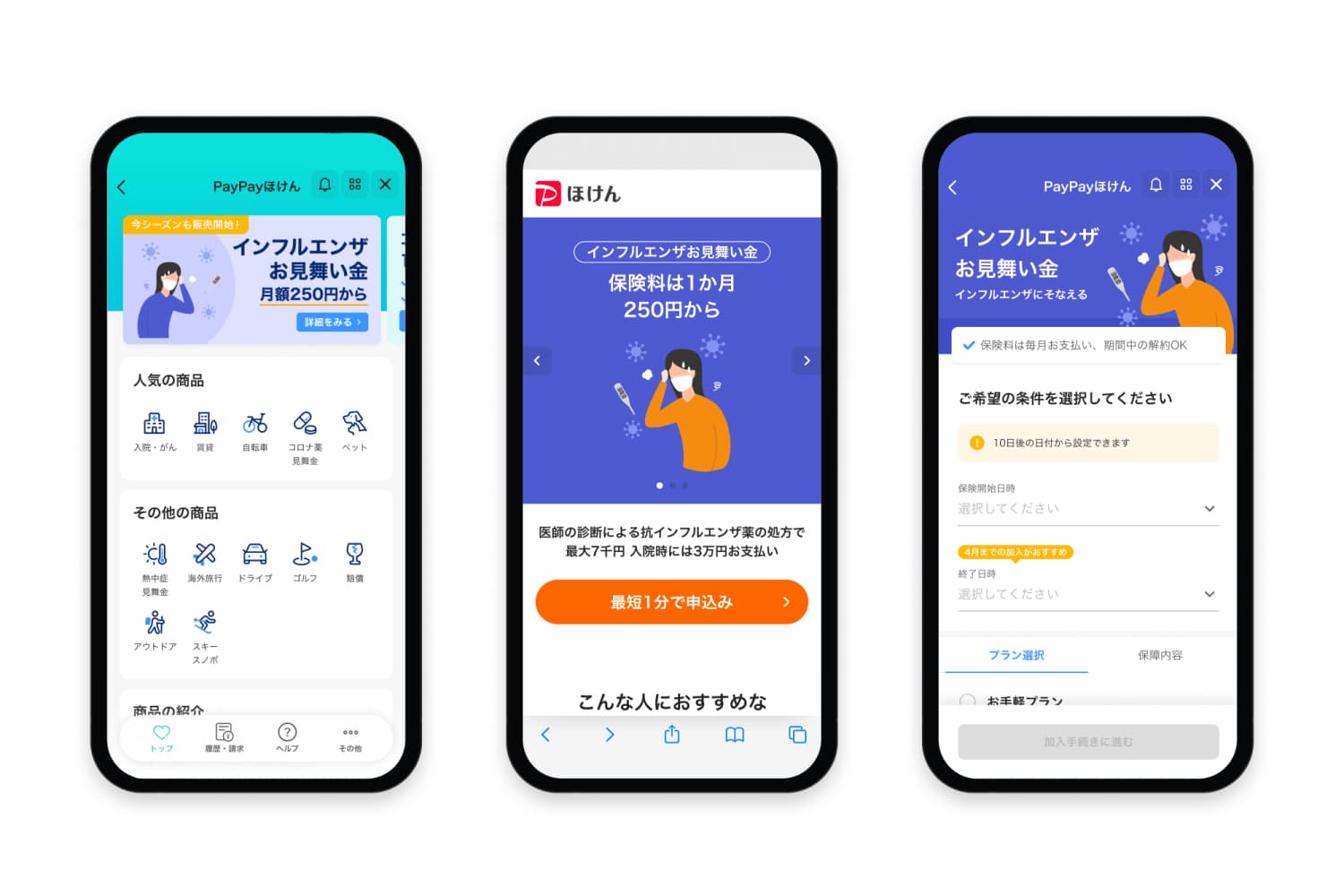

PayPay Insurance Service Corporation (hereinafter PayPay Insurance Service), a group company of LY Corporation (hereinafter LY) and PayPay Corporation (hereinafter PayPay) are pleased to announce that the Influenza Insurance (hereinafter Insurance) is again on offer in the PayPay Insurance mini app*1 within the cashless payment service PayPay starting today. This Insurance was launched in October 2022 as the first product in Japan specifically designed for influenza,*2 and has been well received by many users, with the total number of purchases exceeding 144,000.

A repeat discount*3 is available again this year, allowing last year’s policyholders to apply for as little as 240 yen a month. *4

*1. A feature that allows users to smoothly make reservations, order products, and make payments for services provided by PayPay’s partner companies from the PayPay app.

*2. Based on research by Aiaru syougakutankihoken Corporation (as of September 2024).

*3. The repeat discount applies to users who enrolled in the Influenza Insurance purchasers from last year, regardless of their current plan or subscription period. If you apply for the Influenza Insurance again using the same PayPay account as last year, a ¥10 discount will be automatically applied.

*4. If the Easy plan (20-99 years old) is selected.

The Ministry of Health, Labour and Welfare announced, as of October 3, 2025, approximately one month earlier than last year, that the flu season had begun. *5

Considering this situation, PayPay Insurance Service has resumed the offering of this insurance nine days earlier than last year’s launch date, so that users can prepare for influenza as soon as possible.

*5. Ministry of Health, Labour and Welfare, “On the Status of Influenza as of October 3, 2025.”

https://www.mhlw.go.jp/content/001573336.pdf

As Japan’s first insurance product specialized in influenza, this insurance has gained recognition among many users, and in the third year of offering in October 2024, it received approximately 65,000 applications over a period of six months. In addition, the cumulative number of policyholders has surpassed 144,000.

Regarding user trends, people in their 30s to 50s tend to purchase the policy together with family members, such as spouses or parents and children. Across all age groups, more than 70 percent of users select the Safety Plan, which pays a maximum treatment benefit amount of 7,000 yen.

The hospitalization benefit stands at 30,000 yen; however,Koredake Medical Insurance offers more extensive inpatient coverage.

PayPay Insurance Service will continue to help users by providing high-quality insurance products that suit their needs to make insurance even more accessible.

■ Influenza Insurance Details

1. Period of availability and insurance

<Period of availability>

From October 16, 2025 to March 22, 2026

<Period of insurance>

From October 26, 2025 to April 30, 2026

2. Coverage (applicable reasons for the payment of insurance benefits)

<Medical expenses>

When policyholder contracts influenza A or B during the period of insurance and is prescribed anti-influenza medication at a hospital or other medical institution

<Hospitalization expenses>

The policyholder suffers from symptoms of influenza A or B and is hospitalized for two or more consecutive days (one night and two days) for the purpose of treatment.

*The benefits can only be paid out twice.

*Limited to medical institutions in Japan.

3. Plans (premium and insurance benefits)

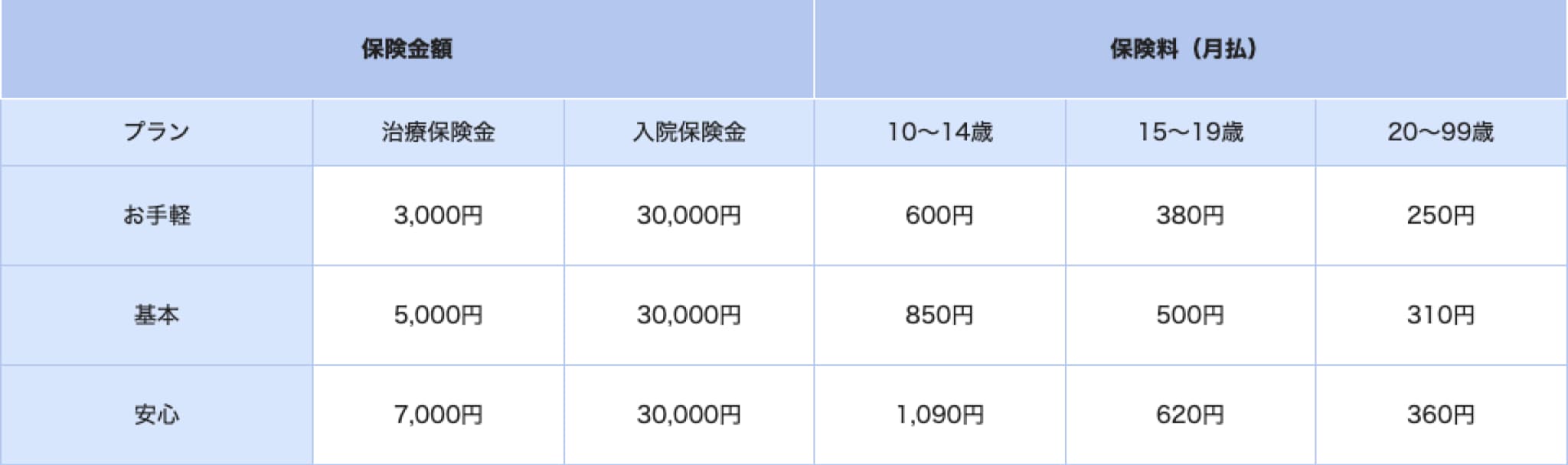

There are three monthly plans: Easy Plan, Basic Plan, and Safety Plan. Plans can be selected according to the needs of users.

*The repeat discount, when applicable, will result in a 10 yen discount of the premium. Those who previously subscribed between October 24, 2024 to March 22, 2025 are eligible.

4. Other characteristics

<Easy to apply> The application and subsequent premium payments can all be completed easily through the PayPay app. The application will be even easier if the user has already verified their identity in the PayPay app, which eliminates the need to input information such as their name. Applications for family members can also be bundled smoothly.

<Easy to file a claim>

Users can file a claim by uploading receipts and statements issued by medical institutions and dispensing pharmacies through the PayPay app.

The insurance benefits will be transferred to the bank account designated by the user.

5. How to use

Users can complete the purchase of an insurance policy with simple steps all within the PayPay app.

The Insurance will be provided by PayPay Insurance Service and Aiaru syougakutankihoken Corporation (President: Katsuyuki Ando), a subsidiary of Sumitomo Life Insurance Company.

Overview of PayPay Insurance Service Corporation

- 1. Name: PayPay Insurance Service Corporation

- 2. Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

- 3. Representative: Yutaka Hyodo, President and Representative Director, CEO

- 4. Business description: Damage insurance agency services, life insurance solicitation services, and small amount short-term insurance solicitation services

Overview of LY Corporation

- 1. Name: LY Corporation

- 2. Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

- 3. Representative: Takeshi Idezawa, President and Representative Director, CEO

- 4. Business description: Development of online advertising business, e-commerce business, subscription services, and management of group companies

Overview of PayPay Corporation

- 1. Name: PayPay Corporation

- 2. Location: YOTSUYA TOWER, 1-6-1 Yotsuya, Shinjuku-ku, Tokyo

- 3. Representative: Ichiro Nakayama, President & Representative Director, CEO, Corporate Officer

- 4. Business description: Development and provision of mobile payment and other electronic payment services

Overview of Aiaru syougakutankihoken Corporation

- 1. Name: Aiaru syougakutankihoken Corporation

- 2. Location: 15-18 Nihonbashi-Kodenmacho, Chuo-ku, Tokyo

- 3. Representative: Katsuyuki Ando, President and Representative Director

- 4. Business description: Provision of small amount and short-term insurances

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.