PayPay Corporation (Shinjuku-ku, Tokyo; President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama; hereinafter “PayPay”) and PayPay Card Corporation (Shinjuku-ku, Tokyo; President & Representative Director: Tomoaki Tanida; hereinafter “PayPay Card”) are pleased to announced that, starting on December 15, 2025, PayPay Points*1 and PayPay Money*2 can be used to repay the monthly PayPay Card debt.

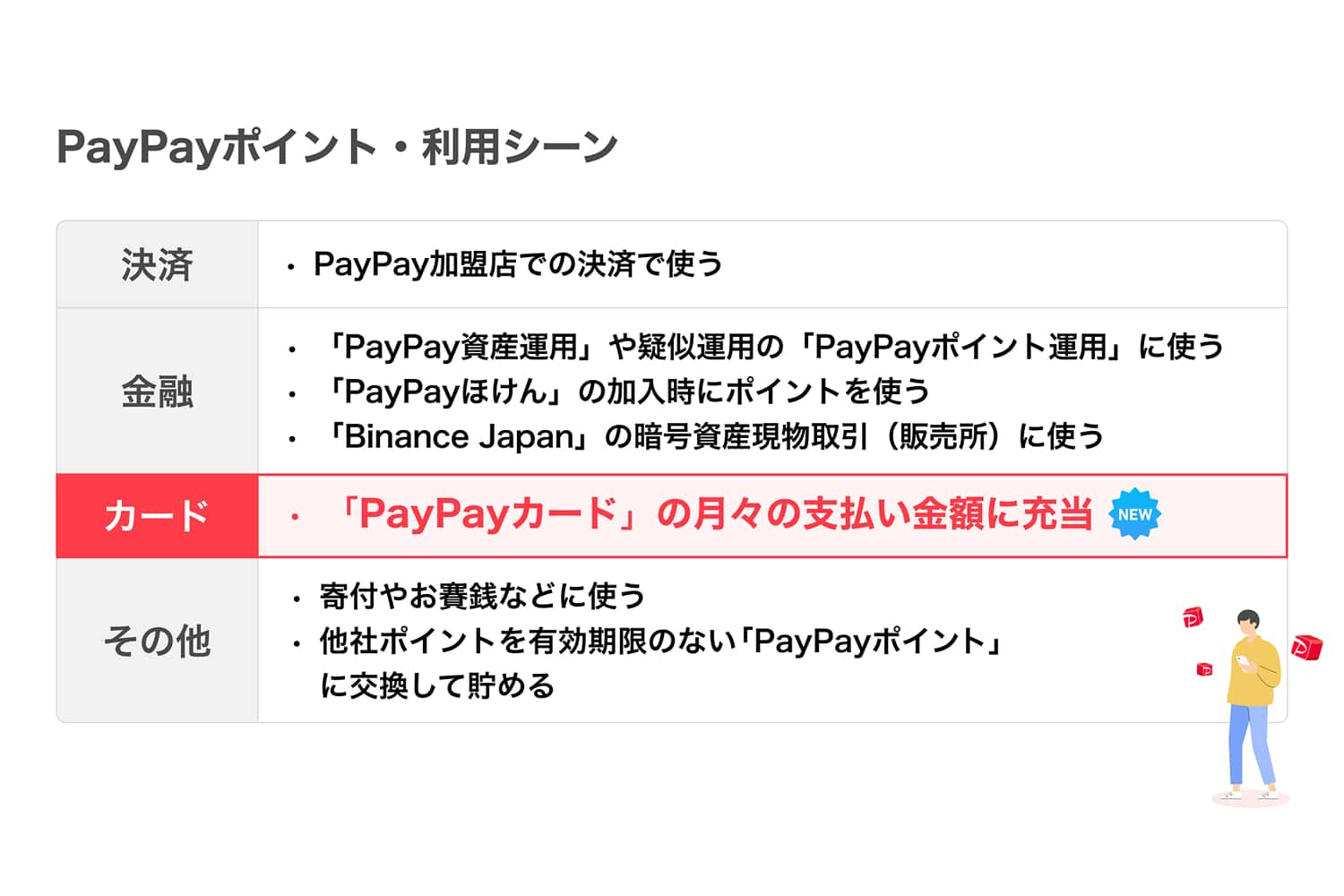

As a result, in addition to previous use scenarios such as purchases at PayPay merchants, point investments, asset management, and financial services including insurance, PayPay Points can also be used for credit card repayments, making the points even more convenient to use.

PayPay Points are primarily earned through payments made with the PayPay app or PayPay Card. Because PayPay Points do not expire,*1 users can accumulate as many as they wish and use them at their own convenience at a value of 1 point = 1 yen when shopping. The points can also be utilized for Earn Points and PayPay Invest to support asset growth. Furthermore, with this update, it has also become possible to use PayPay Points for PayPay Card repayments, improving convenience. Even when the PayPay Card debt exceeds one’s budget due to rising prices and other factors, users can reduce their monthly burden by repaying, in one-point increments, with as many of the points they have accumulated as needed, including points exchanged from other companies and points earned through Earn Points.

*1. Excluding PayPay Points (Time Limited) issued by LY Corporation. Details on PayPay Points (Time Limited) are available here.

*2. This includes PayPay Money (Paycheck) received via the digital salary payment service PayPay Paycheck. PayPay Money Lite is not eligible. In addition, the service is not available in months that include billing for cash advances. Further, the service may be unavailable depending on the card usage status.

To use PayPay Points and PayPay Money to repay the monthly PayPay Card statement balance, a request can be submitted easily via the PayPay Card mini app within the PayPay app. If a request is submitted during the authorization period for the card bill, from around the 12th of the usage month until 3:00 p.m. on the 20th (3:00 p.m. on the 15th for some members), the billing amount will reflect the deduction of PayPay Points and PayPay Money by around 12:00 p.m. on the following day following.*3 The amount used is deemed to have been repaid to PayPay Card, and therefore is also reflected in the available PayPay Card limit. It is also possible to use only PayPay Money, or to request a combination of PayPay Points and PayPay Money. The monthly limits for using both types of money to repay PayPay Card debt are up to 30 requests and up to 1 million yen.

*3. If the request is received after 3:00 p.m., the deduction may be reflected at around 12:00 p.m. on the day after next.

<How to request PayPay Card repayments>

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.