Smartphone Insurance service page:

https://www.paypay-insurance.co.jp/promotion/smartphone/app/

PayPay Insurance Service Corporation (hereinafter PayPay Insurance Service) and PayPay Corporation (hereinafter PayPay), which are group companies of LY Corporation, are pleased to announce the launch of Smartphone Insurance (hereinafter Insurance), an insurance product for smartphones, which can be purchased via the PayPay Insurance mini app*1 within the cashless payment app PayPay. The Insurance covers repair costs and other expenses for breakage, water damage, malfunctions, and theft, and is available for both new and used smartphone devices. Since users can enroll regardless of their mobile carrier, purchase date, or purchase channel, the product helps many users prepare for the unexpected with their smartphones.

*1. A feature that allows users to smoothly make reservations, order products, and make payments for services provided by PayPay’s partner companies within the PayPay app.

In recent years, the prices of smartphones have risen due to increases in manufacturing costs and in the prices of semiconductors and components, and it has become commonplace for the price per device to exceed 100,000 yen.

Furthermore, according to the Consumer Confidence Survey conducted by the Cabinet Office,*2 the average period of use for mobile devices, mainly smartphones, now exceeds four years, and replacement cycles are trending longer. As smartphones become more expensive, are used over longer periods, play a role in many aspects of daily life, and effectively become a necessity, demand is growing for protection services that allow users to continue using their devices with peace of mind.

However, up to now, many smartphone protection services have required users to enroll in coverage provided by manufacturers or mobile carriers at the time of new purchase, or to take out specific insurance within one year after purchase.

At the same time, smartphone purchasing channels have diversified beyond mobile carriers to include e-commerce sites and used-device retailers, and many users have missed the opportunity to enroll in coverage.

In response to this situation, PayPay Insurance has launched Smartphone Insurance, a flexible insurance product that users can enroll in at any time they choose, regardless of when and how they purchased their smartphone or which carrier they use. The Insurance covers not only new smartphones purchased at retail stores and similar locations, but also smartphones whose bundled coverage has expired after initial purchase, smartphones whose bundled coverage ended due to a carrier change, and used smartphones purchased via e-commerce sites and other channels. By providing this Insurance, PayPay Insurance offers flexible and easy coverage for damage, malfunction, theft and similar events involving smartphones, whose prices and usage periods are both increasing, thereby reducing users’ anxiety and financial burden.

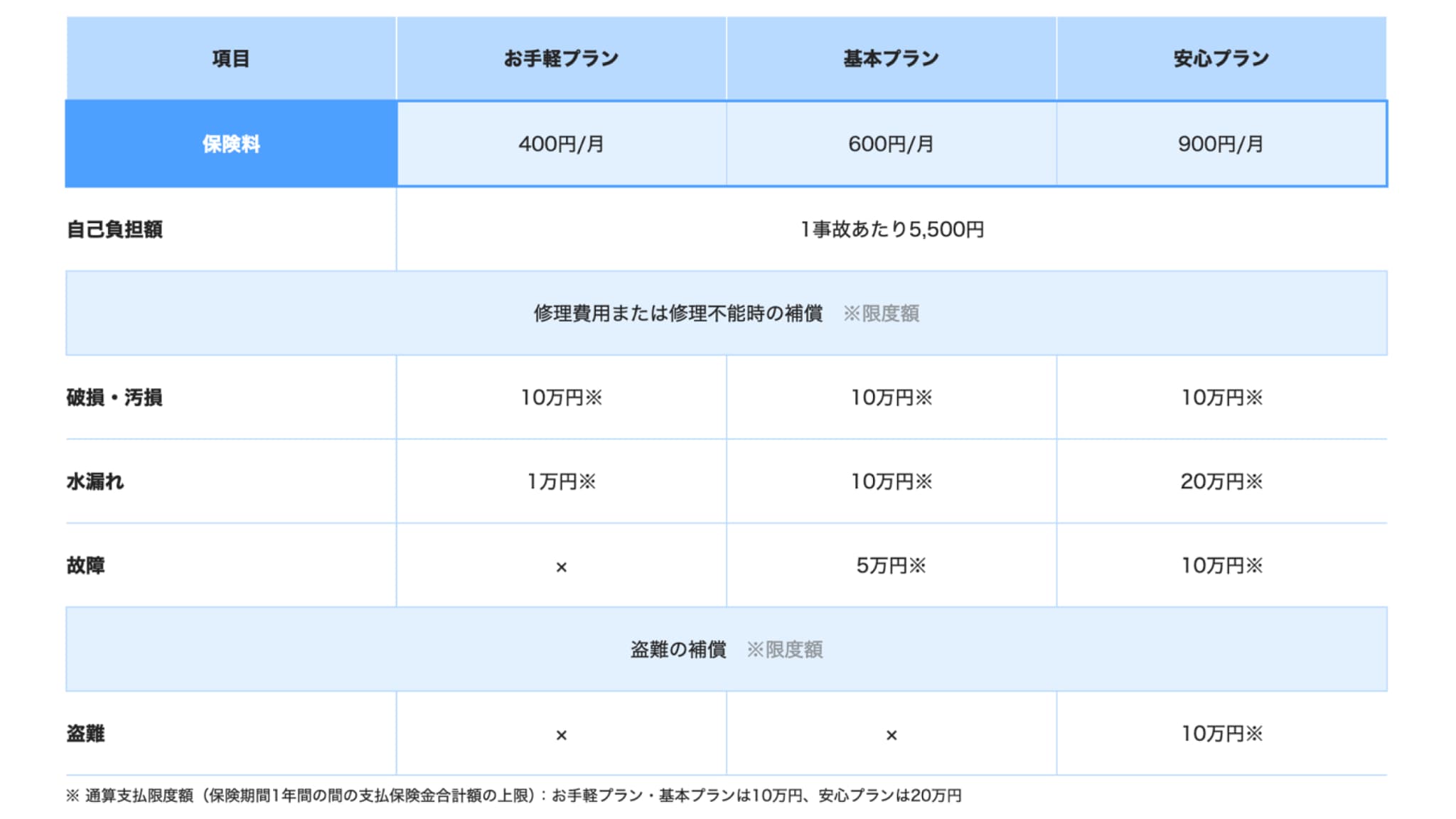

The Insurance is available under the following three plans:

– Easy Plan (from 400 yen/month): Covers repair costs due to damage and liquid immersion (malfunction and theft are not covered). The annual compensation limit is 100,000 yen for repair costs due to damage, and up to 10,000 yen per year for liquid immersion.

– Basic Plan (from 600 yen/month):In addition to the Easy Plan coverage, malfunction is also covered (annual compensation limit of 50,000 yen). The annual compensation limit for liquid immersion is expanded to 100,000 yen.

– Safety Plan (from 900 yen/month):Covers theft as well as malfunction. The annual compensation limit is 100,000 yen for malfunction and theft, and up to 200,000 yen for liquid immersion, offering the most extensive coverage.

For all plans, the user’s out-of-pocket expense is fixed at 5,500 yen, providing a simple and easy-to-understand pricing and coverage structure.

*2. Department of Business Statistics, Economic and Social Research Institute, Cabinet Office, Government of Japan, “Consumer Confidence Survey, Results of the Survey Conducted in March 2025.”

https://www.esri.cao.go.jp/jp/stat/shouhi/honbun202503.pdf

PayPay Insurance Service will continue to provide high-quality insurance products that match user needs in order to “make insurance easy and accessible” and to deliver value to users.

■ Features and Overview of Smartphone Insurance

1)Sales start date and coverage start date

Sales start date: December 15, 2025

Coverage start date: 0:00 a.m. on the day following the application date

2)Coverage (insured events)

If a prescribed event occurs to the insured smartphone and the insured bears repair costs, reacquisition costs or other expenses, repair cost insurance benefits or theft insurance benefits will be paid.

* The covered events differ depending on the coverage plan selected at the time of application.

■ Coverage eligibility

– All mobile carriers

All mobile carriers within Japan, from major carriers to low-cost smartphone services, are eligible.

– Eligible devices

Smartphones that the insured owns or uses, whose functions are all operating normally

(devices such as tablet-type terminals, smartwatch-type terminals, wearable terminals, handheld game consoles, and personal computers are not covered) and that meet one of the following conditions (excluding devices borrowed from rental businesses):

• Devices capable of wireless communication.

• A genuine device of a manufacturer*3 that is sold in Japan, and that displays the Technical Conformity Mark.*4

• A device sold in Japan by a mobile network operator.*5

*3. Including Japanese manufacturers, as well as foreign manufacturers that have established a Japanese subsidiary.

*4. A mark certifying that the radio device conforms to the technical standards stipulated by the Radio Act (Act No. 131 of 1950).

*5. Includes mobile virtual network operators.

3)Plans (features, premiums, and benefit amounts)

■ Plan features

– Easy Plan

A plan that provides essential coverage for damage, contamination, and liquid immersion.

– Basic Plan

A plan that, in addition to the Easy Plan coverage, also covers malfunction.

– Safety Plan

A more comprehensive plan that, on top of the Basic Plan, includes coverage for theft and provides coverage

[If the device cannot be repaired or has been stolen]

The Insurance will pay an amount equal to the value of the insured device (the device involved in the incident) minus the user’s deductible. However, for each incident, the benefit amount is capped at the applicable maximum benefit for the plan as per the table above, and the total amount of benefits paid during the insurance period is capped at the cumulative payment limit.

* “Value of the insured device” refers to the purchase price of the device (or, if unknown, the reacquisition cost of an equivalent model, that is, the value at the time of the incident).

* Documents proving the value of the device involved in the incident (contract, purchase statement, etc.) are required.

* Documents proving the purchase price of the new device (contract, purchase statement, etc.) are required.

* Cumulative payment limit (upper limit on the total amount of benefits paid during one year of the insurance period): 100,000 yen for the Easy and Basic Plans; 200,000 yen for the Safety Plan.

* For details, please consult the insurance company indicated at the time of reporting the incident.

[If the device can be repaired]

The Insurance will pay an amount equal to the repair cost for the insured device minus the user’s deductible. However, for each incident, the benefit amount is capped at the applicable maximum benefit for the plan, and the total amount of benefits paid during the insurance period is capped at the cumulative payment limit.

– If the cumulative payment limit is reached, or if benefits are paid for a total loss (unrepairable) or theft, the insurance contract will terminate.

– Battery replacement due to normal wear and tear is not covered.

This document provides only a summary. Please be sure to check the Important Information, etc. for details.

4)Other features

1. Easy to apply

Users can easily apply through the PayPay app, and premium payments are also completed within the app. If a user has already completed identity verification in PayPay, there is no need to enter certain information such as their name, enabling a smooth application process.

*Identity verification (eKYC) in PayPay is required to apply for Smartphone Insurance. For details on identity verification in PayPay please see here.

2. Earn PayPay Points*

PayPay Points are granted for payments made with PayPay.

*PayPay Points can be used at merchants where PayPay is accepted at a value of 1 point = 1 yen. Points cannot be withdrawn or transferred.

5)How to use

Users can complete everything from plan selection to application in a few simple steps via the PayPay Insurance mini app within the PayPay app. After enrollment, users can start the claims process from the History & Claims section of the insurance mini app.

These insurance products are provided by PayPay Insurance Service Corporation and Zurich Small Amount and Short Term Insurance Co., Ltd. (President: Tetsuya Hattori).

Overview of PayPay Insurance Service Corporation

- 1. Name: PayPay Insurance Service Corporation

- 2. Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

- 3. Representative: Yutaka Hyodo, President and Representative Director, CEO

- 4. Business description: Non-life insurance agency services, life insurance solicitation services, and small-amount short-term insurance solicitation services

Overview of LY Corporation

- 1. Name: LY Corporation

- 2. Location: Tokyo Garden Terrace Kioicho Kioi Tower, 1-3 Kioicho, Chiyoda-ku, Tokyo

- 3. Representative: Takeshi Idezawa, President and Representative Director, CEO

- 4. Business description: Development of online advertising business, e-commerce business, subscription services, and management of group companies

Overview of PayPay Corporation

- 1. Name: PayPay Corporation

- 2. Location: YOTSUYA TOWER, 1-6-1 Yotsuya, Shinjuku-ku, Tokyo

- 3. Representative: Ichiro Nakayama, President & Representative Director, CEO, Corporate Officer

- 4. Business description: Development and provision of mobile payment and other electronic payment services

Overview of Zurich Small Amount and Short Term Insurance Co., Ltd.

- 1. Name: Zurich Small Amount and Short Term Insurance Co., Ltd.

- 2. Location: 3-14-20 Higashi-Nakano, Nakano-ku, Tokyo 164-0003

- 3. Representative: Tetsuya Hattori, President

- 4. Business description: Small-amount and short-term insurance business

Overview of Zurich Insurance Company Ltd.

- 1. Name: Zurich Insurance Company Ltd.

- 2. Location: 3-14-20 Higashi-Nakano, Nakano-ku, Tokyo 164-0003

- 3. Representative: Masachika Nishiura, Representative and CEO in Japan

- 4. Business description: Non-life insurance business

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.