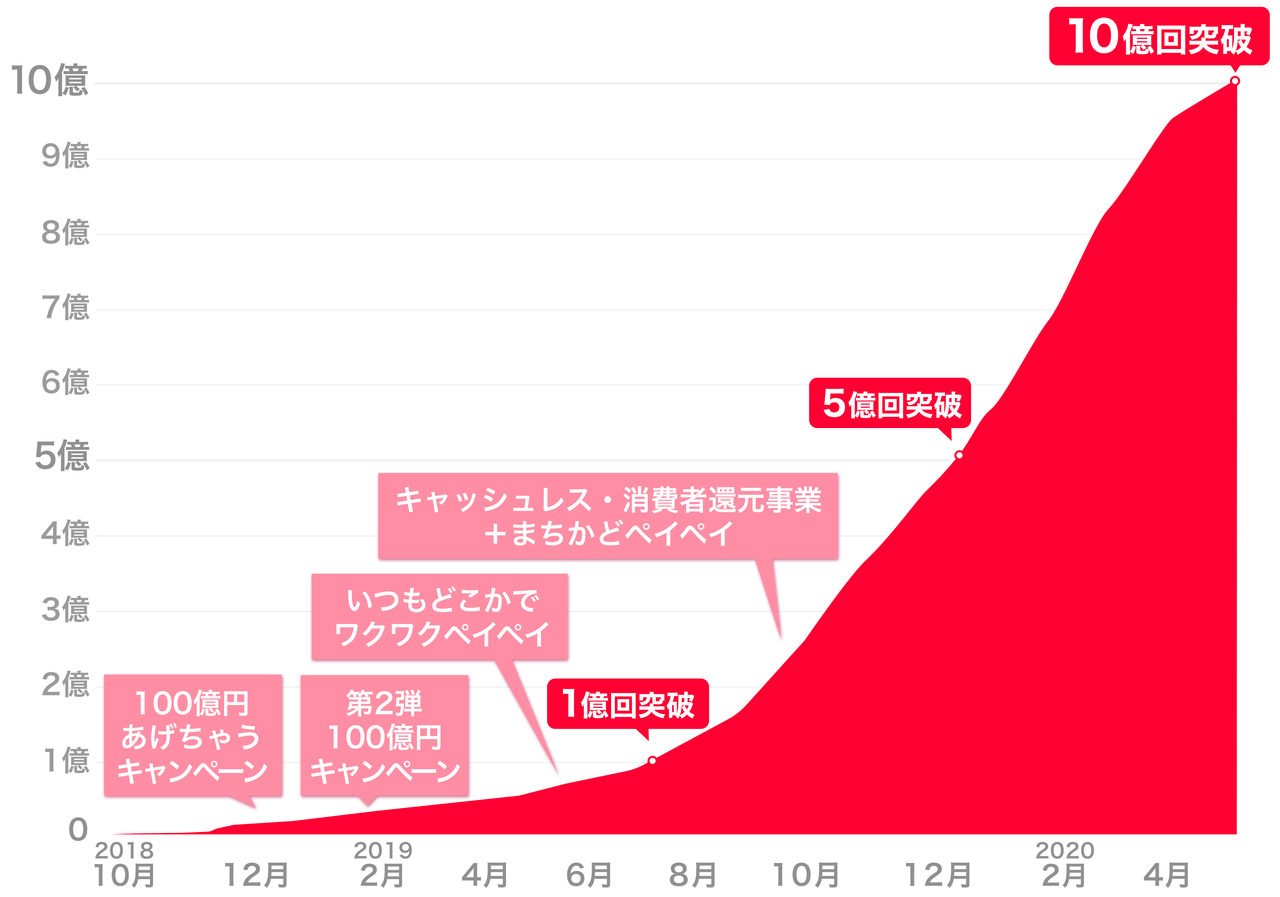

PayPay Corporation, a joint venture between SoftBank Group Corp., SoftBank Corp., and Yahoo Japan Corporation, is pleased to announce that the cumulative number of payments using “PayPay” (*1) has surpassed 1 billion as of May 9, 2020.

The 1 billion mark was achieved approximately 1 year and 7 months after the cashless payment service “PayPay” was launched back on October 5, 2018. We see this as the result of hosting various campaigns every month with merchants across the country, improving the app to make it easier to use, expanding on the number of merchants both offline and online to enable use anywhere in the country, and implementing measures to ensure safe use by our users such as a full compensation scheme in the event of damages caused by unauthorized activities and the provision of a help-line available 24 hours a day, 365 days a year.

Currently, PayPay is supporting the spread of the novel coronavirus (COVID-19) through “Kisekae”. In addition, given the increased need for take-out and delivery services, PayPay is working on various initiatives using the “Mini App” function, including support for delivery services such as “Uber Eats” and plans to offer “PayPay Pickup,” a pre-ordering service for restaurants. Users can make payments on their own smartphone by using “PayPay”, which allows for payments without the exchange of cash between people.

The use of “electronic payments”, such as “PayPay”, in day-to-day shopping is introduced in Examples of practicing a “New Lifestyle” taking the novel coronavirus into account (MHLW website) by the Ministry of Health, Labour and Welfare and we believe the use of PayPay by users and merchants can contribute to the government’s goal of reducing human contact by 80%.

In April 2020, the number of “PayPay” merchants exceeded 2.2 million locations nationwide (*2), which includes many small to medium sized merchants who have never before supported cashless payments”. We feel that the reason that so many merchants are using us is because there is no payment system usage fee (*3) or initial investment required, and the fact that payout cycle is quick allowing for a payout as early as the following day (*4), plus, that the “PayPay” QR code can be utilized for take-out and delivery services, enabling secure payment upon delivery just by showing up with PayPay or with the QR code, without any need for cash or a payment device.

PayPay will continue to provide the convenience of smartphone payments not just to users but also to all available retailers and service providers, aiming to create a world where anyone can feel safe to shop without cash, anywhere in the country. “PayPay” will continue on the path to evolve from a “payment” app to a “super app”, continuing to carry out measures that will provide even more convenience and enrich users’ lives.

※1 This does not include the number of transactions between users utilizing the feature to exchange PayPay balances nor the number of payments using the Alipay app.

※2 The number of applications to use “PayPay” from stores and taxis, etc.

※3 The fee to use the payment system is free until September 30, 2021. It is provided at a fee to companies who have become merchants after April 1, 2020 and have an annual sales of more than JPY 1 billion. Please check here for further details.

※4 By designating Japan Net Bank as the payout account, the payout for payments by “PayPay” will be completed on the following day regardless of the cumulative amount paid. For other financial institutions, the payout will be completed two days later once the monthly cumulative amount paid exceeds JPY 10,000.

■Images can be downloaded here.

*Company names, store names, product names, and service names contained in this press release are registered trademarks or trademarks of their respective owners.