PayPay Corporation, a joint venture of SoftBank Group Corp., SoftBank Corp. and Yahoo Japan Corporation, is pleased to announce the key indicators of the cashless payment service “PayPay” such as number of registered users, as well as some of the major initiatives undertaken in the second half of the fiscal year 2020.

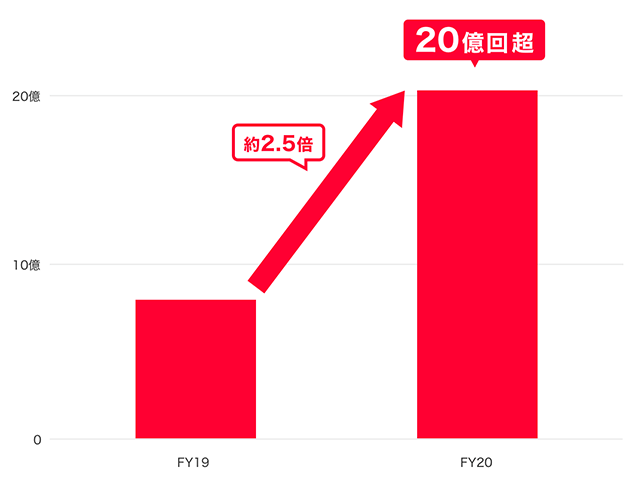

The number of registered users, merchants and payments of “PayPay” have grown steadily despite the impact of the spread of COVID-19. There were more than 2 billion payments between April 2020 to March 2021, approximately 2.5 times more compared to the 800 million payments in the previous fiscal year. The total number of payments during the fourth quarter of FY20 in particular exceeded 600 million in only three months, which was approximately 1.6 times more compared to the same period in the previous year.

[Number of Users, Merchants, and Payments]

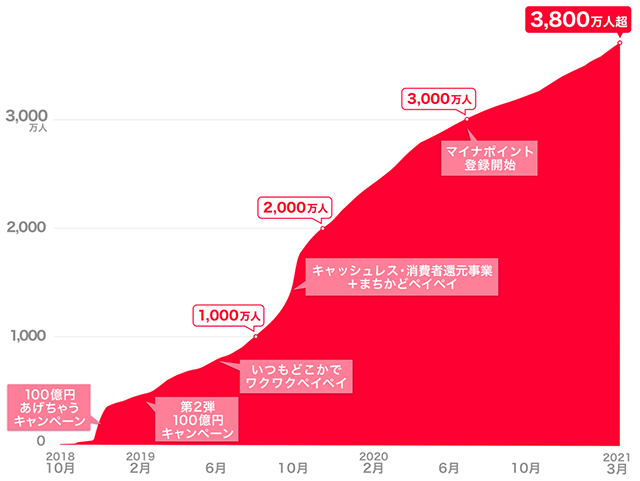

- Number of registered users: Exceeded 38 million (*1)

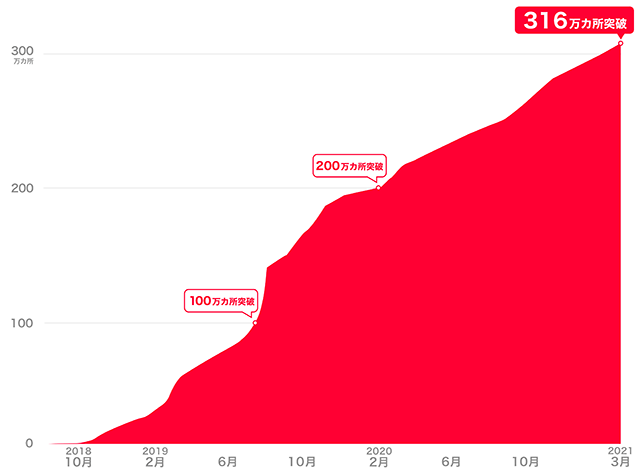

- Number of merchants: Exceeded 3.16 million locations (*2)

- Number of payments: Exceeded 2 billion payments in one year, between April 2020 and March 2021 (*3)

【Growth Chart of Number of users】

【Growth Chart of Number of users】 【Number of merchants】

【Number of merchants】 【Number of payments】

【Number of payments】

【Comparisons with the previous year】

| As of March 2020 | As of March 2021 | |

|---|---|---|

| Registered Users | 27.12 million | 38.03 million |

| Merchants | 2.15 million | 3.16 million |

| Payments | 856.3 million | 2.3892 billion |

*1 Total number of users who have registered for an account, as of March 2021.

*2 Cumulative number of locations registered with “PayPay” including shops and taxis, as of March 2021.

*3. This does not include the number of times users used the “Send/Receive” PayPay Balance feature between users or the number of times users made payments using the Alipay app.

Amidst the growing impact of COVID-19 across the country, PayPay provided an e-payment platform to promote cashless payments as recommended under the New Lifestyle and contributed to the digitization of regional Japan together with local governments. PayPay also provided support to digitize merchants’ sales promotion activities such as through the provision of “PayPay Coupon,” allowing merchants to configure the grant of a PayPay Bonus themselves. Users, on the other hand, were offered convenient mini apps, campaigns with great deals, and a number of measures designed to ensure safety & security. PayPay will continue to provide further convenience to users and work on improving society’s productivity by supporting digitization through promoting cashless payments and increasing & enriching the lineup of services.

【PayPay’s initiatives during the second half of FY20】

<Addition of new services and broadening of existing services>

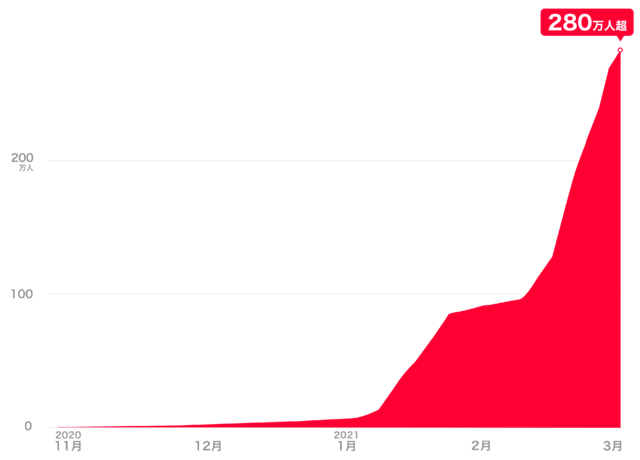

- Launched “PayPay Coupon.” Exceeded 2.8 million coupon users.

- Increased the usage of mini apps “Bonus Management” and “Borrow Money.” Exceeded 3 million users for “Bonus Management” in less than one year from its launch.

- Added the ability to send/receive messages and select background themes when using the “send/receive feature” to exchange PayPay Balance.

<Initiatives utilizing PayPay’s payment platform>

- Provided a payment platform to be used within partners’ apps. Exceeded 3 million users who linked their “Seven-Eleven App” with “PayPay” in only 21 days from launching the service.

- Published the “PayPay” mini app APIs. Provided support for start-up companies and promoted the expansion of mini app features.

- Rolled out the “Support Your Town Project” with local governments.

<Campaigns with special offers>

- Launch of the large-scale campaign, Cho PayPay Matsuri (Super PayPay Festival)

- Exceeded 3 million users who registered “PayPay” under the “Myna Points Program.”

<Efforts in pursuit of safety and security>

- Investigated the access log of the management server and implemented counter measures.

- Implemented anti-fraud measures to ensure an even safer use of PayPay.

■Launched “PayPay Coupon.” Exceeded 2.8 million coupon users

“PayPay Coupon” was launched as of November 2020, allowing merchants to offer a PayPay Bonus at their discretion. Users simply obtain the coupon on the “PayPay” app in advance, to automatically receive the PayPay Bonus when paying with “PayPay” at eligible stores. Since its launch in November 2020, many users have enjoyed the casual access to the benefits offered, and as a result, 2.8 million people have used coupons as of the end of March 2021. On the other hand, “PayPay Coupon” enables merchants to carry out efficient & effective measures to reach the 38 million PayPay users nationwide, without the need for in-store operations such as checking or collecting the coupon upon payment required with the traditional paper-based coupons and discount tickets. This is leading to many more merchants issuing their own “PayPay Coupon.”

【Growth of PayPay Coupon users】

【Growth of PayPay Coupon users】

■ Increased the usage of mini apps “Bonus Management” and “Borrow Money.” Exceeded 3 million users for “Bonus Management” in less than one year from its launch

Usage of the “Bonus Management” service provided by PayPay Securities Corporation which allows users a simulated investment experience using PayPay Bonus and the “Borrow Money” service provided by PayPay Bank Corporation which allows users to apply & take-out credit card loans both increased. The number of users of “Bonus Management” has been growing steadily and became the fastest in the industry* to reach 2 million users. As of April 5, 2021, just one year after the service was launched, the number of users exceeded 3 million. The multi-partner strategy to become a “super app” will be continued in fiscal year 2021 with particular focus on financial services, by collaborating with financial institutions and other companies handling financial products not limited to group companies.

*Comparison of major pseudo-investment point management service providers (Credit Saison Forever Point Management Service, d Point Investment, Rakuten Point Management, in alphabetical order) (as of February 10, 2021, according to PayPay Securities).

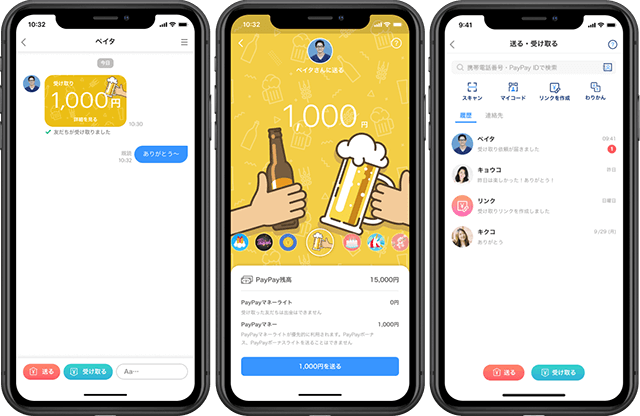

■Added the ability to send/receive messages and select background themes when using the “send/receive feature” to exchange PayPay Balance

A chat feature, allowing users to exchange messages other than when sending/receiving PayPay Balance and a theme feature, allowing users to select a background design (theme) when sending PayPay Balance was added to the “Send/Receive” PayPay Balance feature.

With the addition of the chat function, users can now make requests or consult the other person before actually sending their PayPay Balance. They can also send a thank you message and communicate after they receive the PayPay Balance. There were also many requests from users wishing to have the choice to select a design when sending PayPay Balance, in response to which, a feature was added to enable users to select a theme according to the occasion, such as a celebration theme or appreciation theme. These features allow users to have more fun communicating, rather than merely sending their PayPay Balance.

■Provided a payment platform to be used within partners’ apps. Exceeded 3 million users who linked their “Seven-Eleven App” with “PayPay” in only 21 days from launching the service

As the first step in the initiative to provide PayPay’s payment platform within partner apps, “PayPay” was made available on the “Seven-Eleven App” from February 25, 2021. The number of users who have linked the “Seven-Eleven App” with “PayPay” exceeded 3 million in the first 21 days after its launch. Before the launch, users had to separately present their “Seven-Eleven App” membership code when making a payment in order to earn rewards such as badges and Seven Miles but now, they can earn the rewards upon making a payment simply by presenting the PayPay payment barcode from within the “Seven-Eleven App.”

Partner companies can improve the usability of their app simply by integrating the payment feature provided by “PayPay” without having to develop something from scratch. Users who already use “PayPay” can link their account via a simple initial settings process. Since “PayPay” is used by over 38 million users, businesses can expect a large number of users to link their accounts. PayPay will continue to strive to get more partners on board the “PayPay” payment platform.

■Published the “PayPay” mini app APIs. Provided support for start-up companies and promoted the expansion of mini app features

On October 26, 2020, open APIs for use in “PayPay” mini apps was made available in “PayPay for Developers,” a developer-friendly tool to easily implement “PayPay” as a payment system for online services such as e-commerce sites and apps. Through the provision of open APIs, companies wishing to develop their own services as a mini app will be able to do so themselves, gaining access to the platform “PayPay” used by over 38 million people to acquire new customers and higher usage.

In parallel to the provision of the open mini APIs, PayPay launched the “PayPay Accelerator Program” together with Z Venture Capital Corporation. and East Ventures to foster the growth of start-up companies and increase the lineup of mini app features available in “PayPay.”

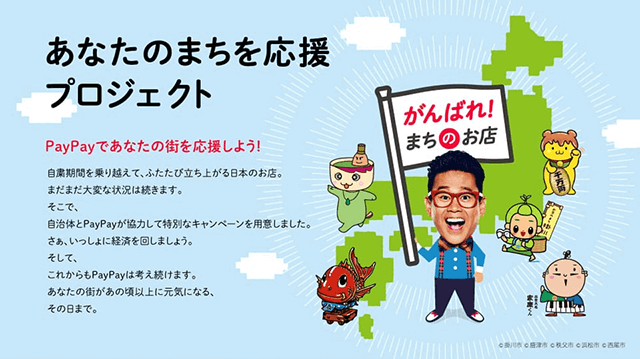

■Rolled out the “Support Your Town Project” with local governments

In response to the major impact of COVID-19 on local economies, PayPay launched the “Support Your Town Project” in July 2020 to implement initiatives using the “PayPay” payment platform in collaboration with local governments. As of April 2021, campaigns have been fixed with 38 prefectures across Japan. The use of “PayPay” eliminates the need for local governments to issue, exchange and print vouchers and gift certificates as well as the need for users to go to a specific location to purchase such gift certificates. As such there are many benefits for both local government and user. Further campaigns are scheduled to be hosted throughout the country.

■Hosted the mass-scale campaign “Cho PayPay Matsuri”

In October and November 2020, and again in March 2021, PayPay hosted a mass-scale campaign “Cho PayPay Matsuri” to offer savings at PayPay merchants and online shops nationwide. In particular, the “Cho PayPay Matsuri” in March, the second campaign, included the “Cho PayPay Matsuri: 20% back campaign worth up to 1,000 yen” in addition to many other campaigns. PayPay will continue to offer measures to make cashless payments more convenient and lucrative for both users and merchants, encouraging more people to use the services provided.

■Exceeded 3 million users who registered “PayPay” under the “Myna Points Program”

The number of users who registered “PayPay” under the “Myna Points Program,” a program hosted by the Ministry of Internal Affairs and Communications from September 1, 2020, topped 3 million as of April 2021. By getting registered under the “Myna Points Program” and topping up to “PayPay” during the period of the “Myna Points Program,” users become eligible to receive 25% back on the amount topped up as PayPay Balance or the amount paid using “PayPay.” (Grant limit: 5,000 yen worth during the period)

The application period for payment providers to participate in the “Myna Points Program” has been extended to September 30, 2021, with the expectation for further users to get registered. To register “PayPay,” it is necessary to apply for a My Number Card before April 30, 2021.

■Investigated the access log of the management server and implemented counter measures

It was announced back in December 2020 that a maximum of 20,076,016 records stored in the server managed by PayPay could have been accessed, however, it has since been identified through a detailed investigation that the number was in fact 2,101 records. It has also been confirmed that there was a single access from Brazil, as per the initial announcement.

Although a flaw in the access right settings of the server, in which information about inquiries from PayPay merchants is stored, was detected through the business process inspection conducted in parallel on PayPay’s systems, a detailed investigation revealed that there was no access by an unauthorized third party.

PayPay has, in addition, conducted an inspection on business processes of “PayPay” related systems and is currently improving the system change management process, including prior approval for changes, double-checking of work and thorough storage of system change work records. Various measures to prevent recurrence, such as strengthening security checks and implementing regular access monitoring, are progressing as planned.

■Implemented anti-fraud measures to ensure an even safer use of PayPay

To ensure safe & secure cashless payments, PayPay has teamed up with financial institutions, has deployed fraud detection systems and has a 24/7 monitoring structure in place by a dedicated team. Should PayPay detect or identify any fraudulent use, the account subject to fraudulent use is immediately suspended. In addition, a full compensation scheme is offered in the event of any damage, back since August 2019.

In addition to the new feature added in September 2020 to enable setting a limit on the maximum amount that can be spent per day or per month, a login control feature was added to manage use across multiple devices and identity verification through “Simple Verification (eKYC)” was made mandatory when registering a financial institution account with “PayPay” both during the second half of the year, to further enhance security. PayPay will continue to develop and establish an environment which will ensure safe & secure use by all users. For more information, please see “PayPay’s Commitment to Safety.”

PayPay will continue to offer the convenience of cashless payments to users as well as all kinds of retailers and service providers, with the goal of creating a world in which a safe cashless shopping experience can be enjoyed anywhere in Japan. “PayPay” will continue on the path to evolve from a “payment app” into a “super app” that will make users’ lives richer and more convenient, fostering a culture of “Anytime, Anywhere with PayPay.”

■About “PayPay,” the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a “send/receive” feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or “bonus management”, a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer, Registration#: Director-General of the Kanto Finance Bureau, No. 00710

・Fund Transfer Operator, Registration#: Director-General of the Kanto Finance Bureau, No. 00068

・Bank Agency Operator, License#: Director-General of the Kanto Finance Bureau, No. 396

・Telecommunications Carrier Registration: A-02-17943

* “PayPay” provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants as long as it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using The PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Act on Fund payment. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). In addition, PayPay Bonus and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will expire.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third party using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation if compensation is also provided by a third party), given that the prescribed conditions are met. Please see“Applying for compensation”for details.

*Company names, trade names, and products/services in this press release are registered trademarks or trademarks of their respective companies.